Why VCs struggle with diversity & inclusion

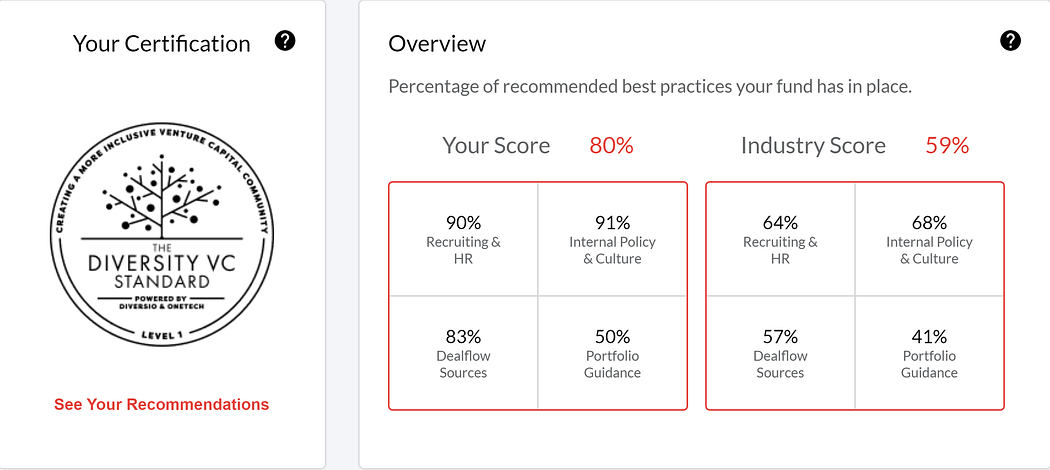

Earlier this April, RAISE Ventures has been certified with the Diversity VC Standard, a powerful initiative from the UK which aims at bringing more diversity in the Venture Capital industry. Let’s be honest: when we started the assessment process, we thought it would be a piece of cake for a fund like RAISE — built around core principles like gender parity — to gather the required elements in order to prove our commitment on these topics. In fact, the journey has been much more intense than what we first expected… How come?

RAISE was built around core values… yet there are not enough

When Clara Gaymard created RAISE in 2013 with Gonzague de Blignières, what she had in mind was to set up a rich ecosystem for startups while enhancing fairer values in Tech, among them gender parity. From then on, we have tried hard to apply this principle in every choice we made, whether it be in our recruitment process or through our investment decisions. Today, we are very proud to count 48% of women in our investment teams which represents a greater percentage compared to the rest of the industry. In the UK for example, women represent on average 30% of the VC labour force.

(Source: Diversity in UK Venture Capital 2019, a study of Diversity VC)

However, as we were auditing the different buckets of the Diversity VC assessment, we realized how far we were from a proper Diversity & Inclusion policy.

Just to name a few, here are some fields where we lack clear policies:

- Inclusion in our HR processes: ideally, we’d like to widen RAISE’s applicant pool beyond traditional sources, while reducing bias in the hiring process;

- Inclusion in the workspace: it implies chosing a representative for all harassment and discrimination matters, setting periodic organisational culture surveys, designing inclusive office spaces, but also organizing leadership and anti-harassment trainings;

- Helping our portfolio to master diversity & inclusions (D&I) subjects: whether it is by bringing additional guidance for underrepresented portfolio founders, by tracking diversity on our portfolio’s boards of directors or by providing mental health support, there are many ways to help our portfolio startups achieve more diversity and inclusion.

We know there is so much more to do, and we’re glad initiatives like Diversity VC exist in order to open the way and shake the VC world. But looking around, we also realized we were not the only ones in the European landscape lagging behind on these topics. Why is it so difficult for the VC industry to move forward on D&I matters?

Diversity and Inclusion (D&I): a problem with deeper roots in the VC industry…

What exactly is D&I?

In Atomico 2018’s Diversity & Inclusion in Tech Guide, diversity is defined using 3 criteria:

- Demographic: age, race, gender identity, sexual orientation, physical resources;

- Experiential: economic or social position, education, occupation, faith, abilities, dependents, caring responsibilities;

- Cognitive: how we approach problems and think about things.

As Niklas Zennström, Founding Partner and CEO of Tier-1 VC Atomico, states in this report: ‘Diversity describes the range of human differences within a group of people’. Inclusion, on the other side, is defined as ‘the act of making someone feel part of a group’.

I know what you’re thinking right now: what’s the difference between being diverse and inclusive? Verna Myers, a lawyer, entrepreneur and author brilliantly phrases it:

‘Diversity is being invited to the party; inclusion is being asked to dance’.

Now that you get the picture, let’s see how these two concepts apply (or not) to VC industry.

An elephant in the room: VCs are everything but diverse nor inclusive

Based on measurable criteria, it’s obvious that VC funds don’t leave space for much diversity. Statistics tend to prove it. Just in terms of demographics, most VC partners are white men above 50. According to Diversity VC, in the UK, 76% of venture capital professionals are white, compared to 59% of the London population. In terms of gender, the representation of women among VCs is slowly increasing, from 27% in 2017 to 30% in 2019 — and most women occupy junior or middle positions.

From meritocracy to “mirrortocracy”

It’s not only about demographics: a 2018 study found that among the 1500 US venture investors surveyed, 40% of them had attended Stanford or Harvard. The author, Richard Kerby (partner at Equal Ventures), makes it very clear:

‘With 82% of the industry being male, nearly 60% of the industry being white male, and 40% of the industry coming from just two academic institutions, it is no wonder that this industry feels so insular and less of meritocracy but more of a mirrortocracy.’

What happens if we, investors, all come from the same background and share a similar mindset? Well, we are likely to think the same way… Which is bad for our fund’s stategy and performance. As pointed out in Maddyness UK in April 2021, another 2018 study looking at diversity in VC noted that “the more similar the investment partners, the lower their investments’ performance”. You crave for figures to be fully convinced, right? Here are some:

“For example, the success rate of acquisitions and IPOs was 11.5% lower, on average, for investments by partners with shared school backgrounds than for those by partners from different schools. The effect of shared ethnicity was even stronger, reducing an investment’s comparative success rate by 26.4% to 32.2%.”

For all these reasons, tackling the lack of diversity and inclusion in VC investment teams should be considered as one of our top priorities. Where does this endogamy come from?

For Julia Rabin, Project Lead at Diversity VC, there are two main reasons that could explain the lack of diversity in VC industry — in addition to the fact that VCs usually hire talents from homogeneous pools like famous universities. Indeed, according to Diversity VC 2019 report, one in five UK venture capitalists studied at Oxford, Cambridge, Harvard or Stanford. But for Rabin, besides this and even if diversity as a whole is improving, VC industry specific hiring cycle (known as the ‘partner track’) explains why it is hard to see visible changes on the short run. ‘Partners are tied to their fund for a long time — usually 10 years’, she says. ‘Plus, it takes a long time for a junior to become a partner’. Therefore, we need to be patient to see women, that are more likely to be hired at a junior level, to reach the partner level.

The second aspect is also tied to how VCs work. Based on our experience, most of them (including us) rely a lot on their network to sources startups and, quite logically, they do so when they’re looking for talents to hire. That’s where the network effect plays its role. ‘With programs like Future VC, we aim at breaking that cycle, by opening up VC networks to more individuals’, explains Julia Rabin. In fact, from the outside it seems like VCs act as ‘gatekeepers’ — as Afro-American VC Sydney Thomas testifies in a 2019 interview : ‘I think the hardest part about breaking in to venture is that pretty much everyone is qualified to do it, so the gatekeepers purposefully obfuscate how to get in.’

Isn’t it ironic? (don’t you think)

So we know that we, VCs, are not doing it right when speaking about being diverse, especially when it comes to hiring. Some of us are tempted to say that it’s not because we don’t want to hire more diverse people, but it’s just that there are not enough diversity among candidates. Ahem. Could it be a pipeline issue, really?

In a recent article published in Forbes, VC Elizabeth Edwards, Managing Partner of H Venture Partners, firmly rejects this kind of argument: ‘What’s especially interesting about firms that claim that they “can’t find diverse candidates” is that they claim to be top in the world at “finding the best startups” and “finding the best talent for startups”. If a VC’s job is to find the unicorn-shaped needles in the haystack, either they are not as good as they claim at finding things — or they’re simply not trying.’ Nothing more to add. Or maybe this powerful quote from Frederik Groce, a principal at Storm Ventures, who goes even further in Wired:

‘If you have a problem finding talent, or you think there’s a “pipeline problem”, well, no, there’s a filtering problem.’

For the moment, VCs are not inclusive because their teams are not diverse enough yet. It may seem a bit ironic that we’re not ready to take risks by broadening our sources for internal talents, whereas taking risks and betting on external talents is what we’re paid for.

At RAISE, we understand that being more inclusive is also how we will manage to attract diversified candidate profiles! Where else can we find inspiration in order to make space for more D&I in our workspace?

…that Tech companies are already tackling with a lot of energy

One of the areas we want to improve on is the way we help our portfolio companies achieve more D&I themselves. Fortunately, they didn’t wait for us to do so! An inspiring example is Castalie, whose mission is to to put an end to the plastic bottles madness thanks to filtered water coolers.

In December 2020, Castalie joined #TechyourPlace, a newly created movement aiming at diversifying the way startups hire their employees. In an interview, Cristina Zamfir, Chief Human resources Officer at Castalie said that they truly believe ‘performance and excellence are reached thanks to diversity and inclusion’. Therefore, Castalie wants to make sure candidates feel they can ‘come as they are’.

Performance is one of the reasons why Tech companies need to broaden their views when sourcing talents. But it’s not the only one! A study realized by Firstalent in September 2020 found that by being more diverse, startups wanted to attract the best candidates and become more socially responsible as companies.

Initiatives to grow and diversify the pipeline of candidates

This ‘pipeline issue’ that both startups and VCs meet when hiring can be solved by subscribing to dedicated programs. Academy is one of them in the UK: their mission is to select and train graduates from all backgrounds in order to give them the opportunity to join a leading tech company. Last month, Academy organized a session on Clubhouse to talk about the lack of diversity in Tech. For Thea Fisher, Head of Partnerships at Academy, ‘someone needs to make an investment in order to have a more diverse ecosystem’. In the case of Academy, it’s tech companies who finance the 2-years training of future applicants.

There are plenty of emerging initiatives for VCs as well. We can think of BLCK VC in the US, Future VC by Diversity VC, Included VC in the UK or SISTA in France. As Included VC states on their website: ‘Entrepreneurialism and potential are equally distributed, but venture capital is not.’ That’s why the Tech ecosystem needs ‘outlier VCs to invest in outlier entrepreneurs.’

It is not an egg-and-chicken problem: after all, it doesn’t really matter who, between VCs and startups, needs to act first for more diversity and inclusion. Because, as Julia Rabin told us, ‘when it comes to D&I, everyone can learn from everyone’.

From a nice-to-have to a must-have

One thing remains certain: if VC funds don’t move fast enough, they will become less and less competitive in attracting the new generation of talents. Adapting and evolving is a must-have to stay ahead of the talent race. New certifications and standards are getting more and more valued by the whole ecosystem — both LPs and startups are looking for VCs with clearer D&I policies and aligned values.

From our experience at RAISE, we know how difficult it is to move forward but we are on the right track. We’re proud of receiving the Diversity VC standard, which is the first milestone of a bigger roadmap that we are still working on. See you next year to measure our achievements!

RAISE Ventures team

Retour aux articles